Exclusive: Member of Parliament Reveals Council’s Rejection of Central Bank Governor’s Proposal on Exchange Rate Fees

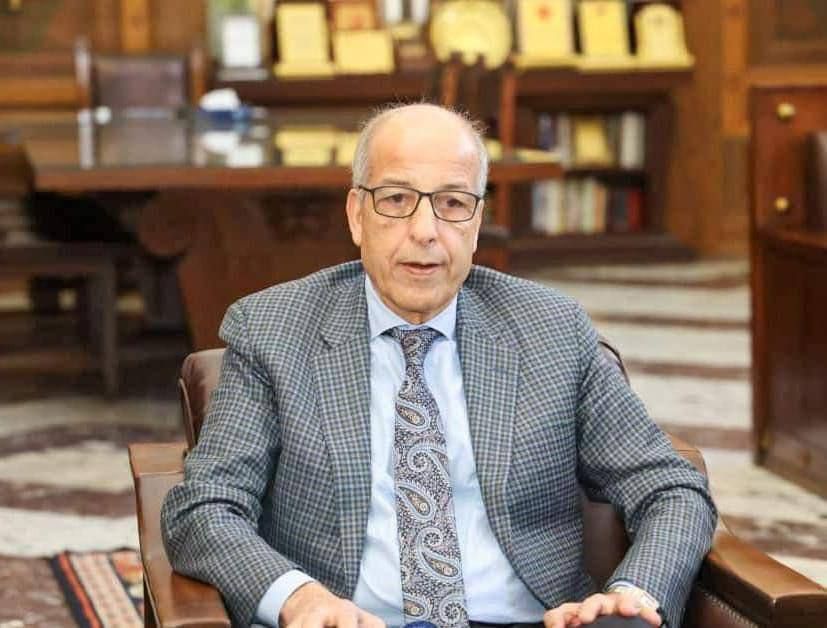

A member of the House of Representatives stated to Tabaadul channel today, Wednesday, that the House of Representatives will not agree to the proposal of the Central Bank Governor, Seddiq Al-Kabeer, to impose fees on the exchange rate at a rate of 6.15 or 5.95 dinars to the dollar because the parliament is a legislative authority whose role is to issue laws and legislation, monitor the government, and hold it accountable. As for the exchange rate, it falls within the jurisdiction of the Central Bank’s Board of Directors, according to Law No. (1) of 2005 concerning banks.

Central Bank of Libya Governor had sent a letter to the Speaker of the House of Representatives days ago, in which he proposed a solution to the problem of the exchange rate increase in the parallel market by imposing a tax on the official exchange rate by 27% for all purposes except for public sectors with sovereign and service nature, making the exchange rate between 5.95 and 6.15 dinars to the dollar.