Today, Bank ABC Group, (Arab Banking Corporation B.S.C.) whose shares are traded on the Bahrain Bourse under the symbol “ABC”, announced the financial results for the first quarter of 2023.

ABC Bank Group indicated that it had started the year on a strong footing with a 21% growth in revenue, compared to the same period in the previous year, driven by broad core business growth and benefiting from higher interest rates. The balance sheet remained healthy with strong capital and liquidity ratios.

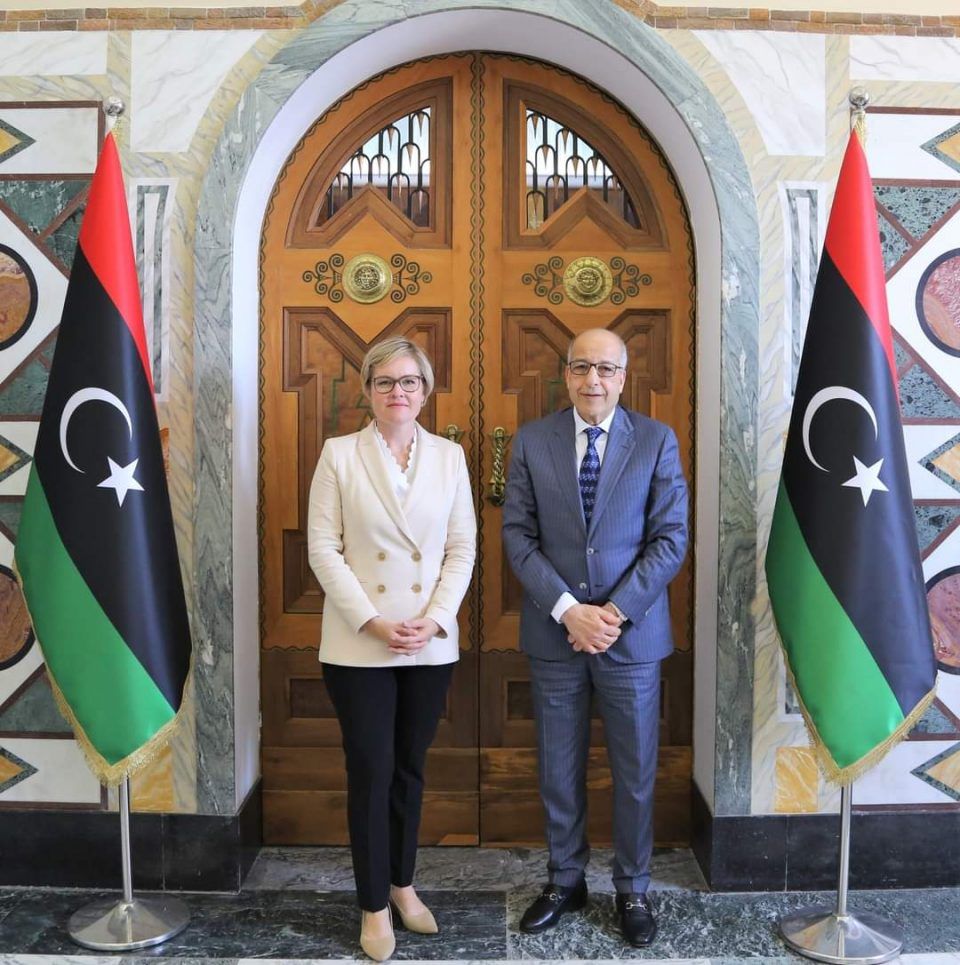

For his part, Chairman of the Board of Directors of Bank ABC Group, Seddiq Al-Kabeer, commented: “We are pleased with the strong start to the year, as we continued to build on the momentum of the core business from last year benefiting from the acceleration of performance, which contributed to increasing our net profit for shareholders in the first quarter by 94% compared to the same period of the previous year, despite the pressures faced by the banking sector globally and the economic challenges in a number of our markets. The diversity of the group’s business portfolio and the strong management of the overall budget place Bank ABC in a position to continue its strong growth and improve profitability during the remaining period of 2023.”

The bank stated that the financial results during the first quarter of 2023 are represented in the consolidated net profits attributable to the shareholders of the parent company for the three months of the first quarter of 2023 amounting to 60 million US dollars, an increase of 94%, compared to 31 million US dollars recorded for the same period from last year.

Earnings per share for the period amounted to $0.02, a growth of 94% compared to $0.01 for the same period last year, in addition to the total comprehensive income attributable to the shareholders of the parent company reaching a loss of $1 million, compared to total comprehensive income of $8 million during the year 2022. This was mainly due to the depreciation of the Egyptian pound against the US dollar, which was offset to some extent by the strengthening of the Brazilian Real.

The group added that the first quarter of this year, the total operating income increased compared to the same period of the previous year by 21%, which reflects the growth in all basic markets, taking advantage of the situation of high interest rates, noting the increase in operating expenses compared to the same period of the previous year by 10% of expenses to support business growth, strategic transformation, and higher inflation. Thus, the Group has a positive income due to an increase in the income growth ratio to the cost growth ratio by 11%, as a result of the improvement in the cost to income ratio. The Group remains focused on cost control while continuing to invest in digital transformation and strategic initiatives to build the “Future Bank”.

The bank group “ABC” showed the general balance sheet in which the property rights belonging to the shareholders of the parent company and holders of perpetual bonds at the end of the period amounted to 4,043 million US dollars, compared to 4,095 million US dollars recorded at the end of 2022, after absorbing the impact of dividends and foreign currency conversion on the rights of ownership in subsidiaries.

Total assets amounted to $34.6 billion at the end of the period compared to $36.6 billion at the end of 2022, down by 7%, primarily reflecting short-term asset and liability management measures. Loans and advances amounted to $17.9 billion, slightly lower than the $18.2 billion recorded at the end of 2022, and deal volumes are expected to pick up over the remainder of 2023.

Liquidity levels also maintained their strength, as the liquidity coverage reached 200% and the net stable liquidity ratio reached 125%. The ratio of the first category of capital is 13.7%, and the total capital adequacy ratio is 16.4%.