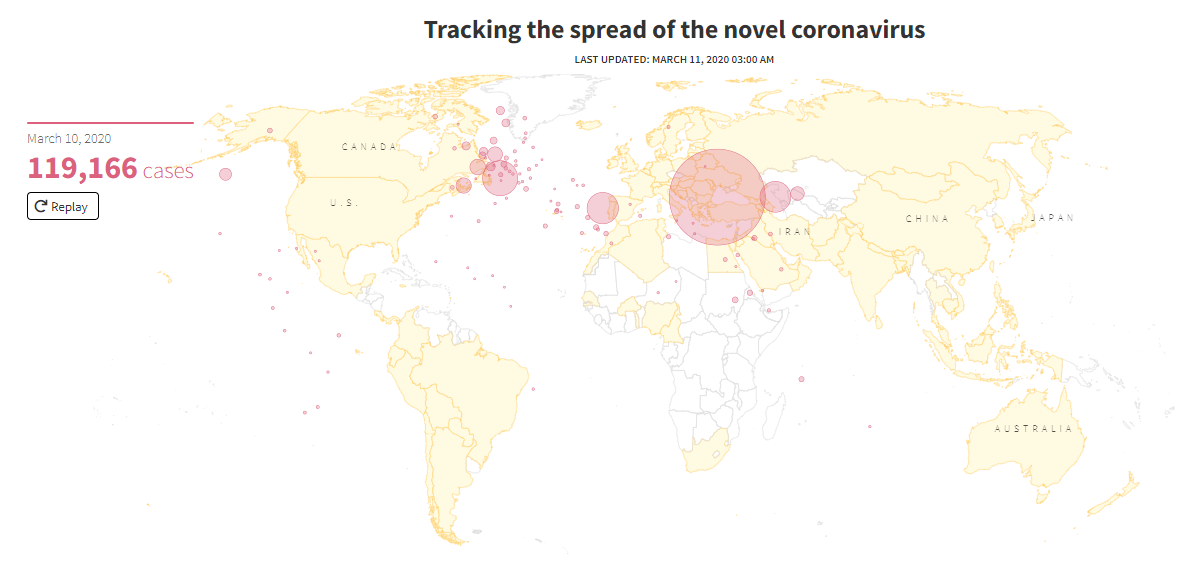

Latest on the spread of coronavirus around the world

The number of people infected with the coronavirus topped 119,000 across the world as the outbreak spread to more countries, causing greater economic damage.

DEATHS/INFECTIONS

More than 117,100 people have been infected globally and over 4,000 have died.

Mainland China had 24 new cases by Tuesday, up from 19 cases a day earlier, bringing the total to 80,778. The death toll reached 3,158, up by 22 from the previous day.

The death toll in Italy jumped by 168 to 631, the largest rise in absolute numbers since the contagion came to light on Feb. 21. The total number of cases in Italy rose to 10,149 from a previous 9,172.

British junior health minister Nadine Dorries has tested positive and is self-isolating.

Italians arriving in Britain are being advised to self-isolate, a spokesman for Prime Minister Boris Johnson said on Tuesday.

Spain, with over 1,200 cases and 30 deaths, decided to close schools and universities in Madrid and the Basque capital Vitoria.

Two passengers on a cruise ship being held outside Marseille are being tested for suspected infection.

The Catholic Church in Poland wants to increase the number of Masses on Sundays to meet crowd limits. With 17 cases so far, the country has canceled all large-scale events.

Russia recommended on Tuesday that people avoid public transport, shopping malls and other public places at rush hour.

Bosnia on Tuesday barred entry to travelers from countries most affected by the coronavirus outbreak, while its Serb region shut all schools and universities and banned public events from March 11 to March 30.

Serbia closed its borders for people from coronavirus-affected countries, Moldova banned foreigners from entering by plane from any country affected, and Denmark suspended all air traffic from virus hotspots.

Austria will deny entry to people arriving from Italy and has banned indoor events of more than 100 people.

The Czech Republic, which has reported 40 cases, will suspend schools other than universities from Wednesday, and ban events hosting more than 100 people.

The European Union will suspend a rule requiring airlines to run most of their scheduled services or forfeit landing slots, as the crisis deepens.

AMERICAS

U.S. President Donald Trump will meet with the heads of some of the largest U.S. banks on Wednesday to discuss the financial industry’s response to the coronavirus epidemic, according to the White House press office.

Canada recorded its first death and Panama confirmed its first case on Monday.

The U.S. Food and Drug Administration and the Federal Trade Commission issued warning letters to firms selling products that claim to prevent, treat or cure COVID-19.

The U.S. Defense Secretary is postponing his upcoming trip to India, Uzbekistan and Pakistan.

Jamaica confirmed on Tuesday its first imported case of the coronavirus, in its capital city of Kingston.

Bolivia has confirmed its first two cases of coronavirus.

Panama said on Tuesday it has confirmed the country’s first death from the coronavirus and seven new people have been infected.

ASIA

Total infections in Japan rose to 1,278, including 696 from the Diamond Princess cruise ship and 14 returnees on charter flights from China. One new infection was reported early on Wednesday, in the western prefecture of Hyogo. The death toll stood at 19 deaths, including seven from the cruise ship.

South Korea reported 242 new cases, compared with only 35 a day earlier, bringing the total to 7,755. The death toll rose by one to 60.

A Turkish citizen was diagnosed with the virus, making him the country’s first confirmed case.

Brunei said six people had tested positive a day after it reported its first case.

Chinese President Xi Jinping visited Wuhan, where all temporary coronavirus hospitals have now been closed, on Tuesday for the first time since the epidemic began, indicating a possible turning point as the virus spread slows in China.

China’s Hubei province said on Tuesday it will implement a “health code” mobile phone-based monitoring system to start allowing people to travel within the province.

Mongolia reported its first case.

Hong Kong will quarantine all visitors from Italy and parts of France, Germany and Japan for two weeks from March 13.

Singapore started charging visitors for coronavirus treatment after it reported new imported cases from neighboring Indonesia.

MIDDLE EAST AND AFRICA

Iran’s death toll jumped on Tuesday to 291 and infections rose to more than 8,000.

The U.N. called on Iran to free all prisoners temporarily, a day after Iran’s judiciary chief said it had temporarily freed about 70,000.

Democratic Republic of Congo confirmed its first case of coronavirus on Tuesday, bringing the number of countries in sub-Saharan Africa hit by the epidemic to seven.

Algeria suspended economic, cultural and political gatherings to slow the spread of the virus

Tunisia will suspend all flights and shipping to Italy except to Rome and bring forward a scheduled school holiday to Thursday from next Monday.

Saudi Arabia’s health ministry said on Monday it has detected five new cases, bringing the total to 20.

Israel, with 42 cases, will require anyone arriving from overseas to self-quarantine for 14 days

Lebanon reported its first death on Tuesday and Congo its first case, bringing the number of countries in sub-Saharan Africa hit by the epidemic to seven.

AUSTRALIA

Australia announced a A$2.4 billion ($1.56 billion) health package that proposes setting up fever clinics and offering cost-free facilities for people to consult doctors over video calls.