Dbeibeh meets with the Board of Directors of the Libyan Investment Authority

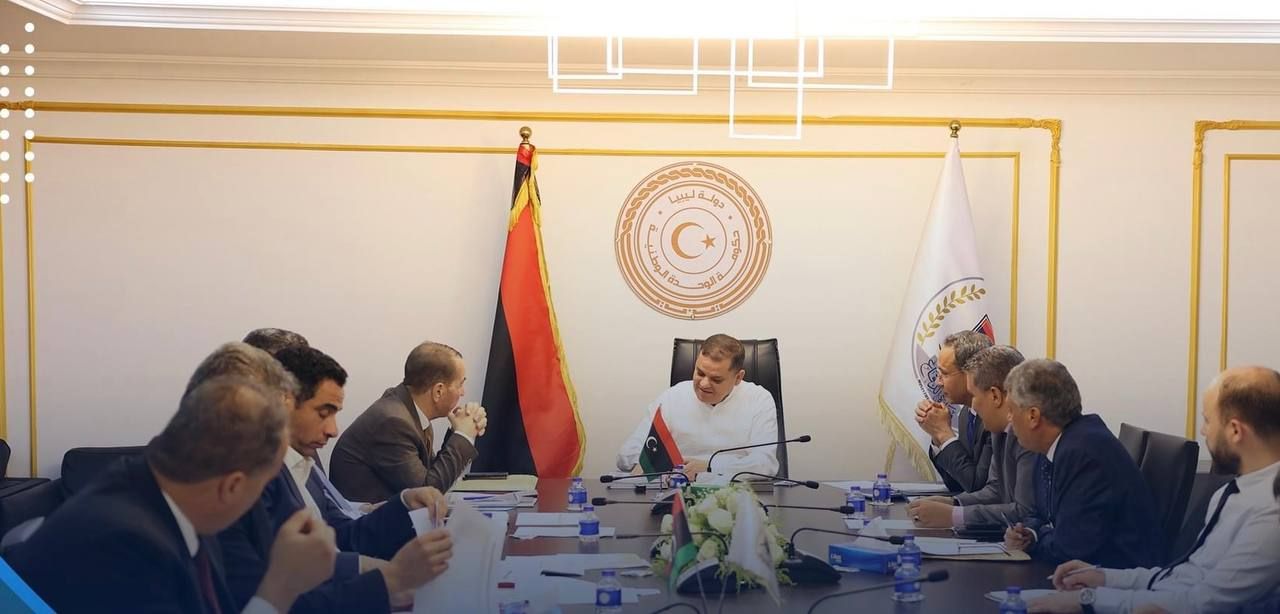

Today, Saturday, the Prime Minister and Chairman of the Board of Trustees of the Libyan Investment Corporation, Abdul Hamid Dbeibeh, held a meeting with the Authority’s board of directors and its subsidiaries to find out the difficulties and problems it faces in performing its tasks and investment plans.

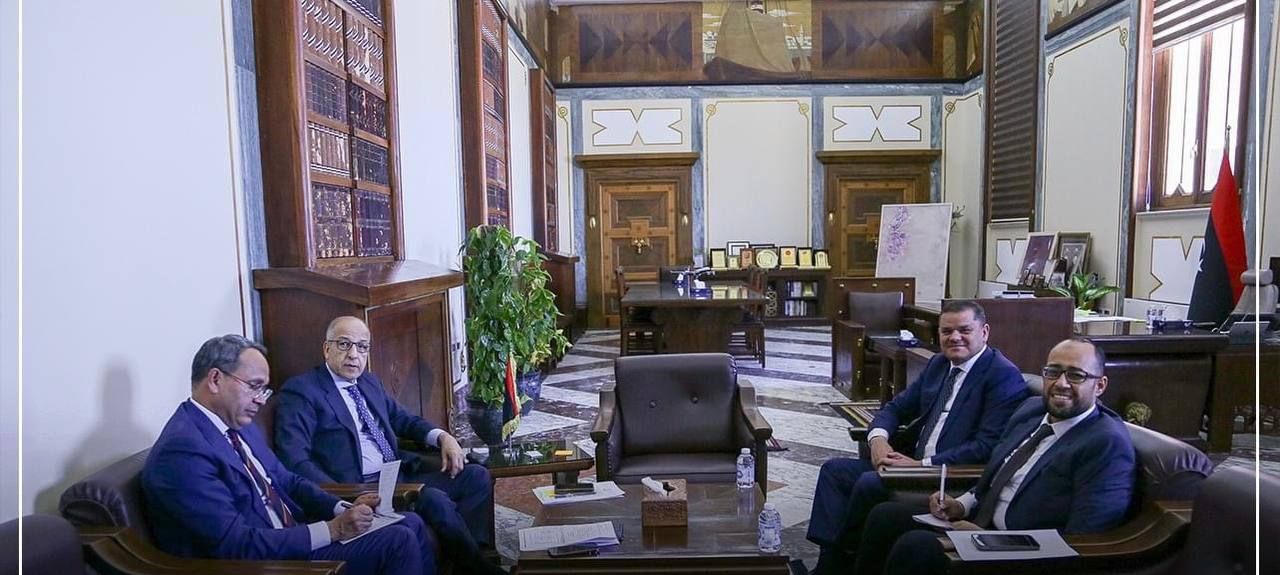

The Chairman of the Board of Trustees emphasized the Authority’s efforts to review and close its final accounts during the past years, which have not been completed for more than 15 years. They were the first goals of the government in the investment file, and now they have been accomplished.

Dbeibeh also stressed the need to invest locally in the field of solar energy, oil and gas in all its fields, and to give it priority in all plans.

The Chairman of the Authority gave a visual presentation showing the investment plan of the Authority and its subsidiaries, indicating the efforts of the employees with international companies in order to close the final accounts and identify and evaluate all investments, whether real estate, financial or in the form of portfolios. He stressed that the Authority was able today to announce consolidated financial statements. He reassured the audience that the Libyans’ money was not lost and was clear in all its details, and that the institution moved from the stage of limiting and protecting these investments to achieving profits and creating successful investment opportunities.

The Chairman of the Board of Trustees of the Authority stressed the need to disclose all investments in terms of their values and programs, and to clarify all data and numbers to the Libyan people, explaining that the lack of appearance and the announcement of results and statistics leaves everyone talking about the Foundation and the loss of its money without the presence of realistic data on it.

Dbeibeh praised the concerted efforts of the Libyan state institutions to protect the Authority’s assets abroad in the face of attempts to seize and plunder, praising the efforts of the Public Prosecutor’s Office in following up cases and rulings issued regarding the Authority internationally in cooperation with the Cases Department, the Audit Bureau and the Central Bank.