The World Bank: The split in the central banks of Libya has stymied control over monetary and fiscal policy

In order to get a glimpse into the extent of how the crisis has impaired the financial sector, the World Bank recently completed a review of the Libyan financial sector.

The review demonstrated that even before the civil war, the Libyan financial sector was not sufficiently developed, and the current political crisis has further weakened the state of financial intermediation and inclusion in Libya.

The financial sector report was prepared under very difficult conditions: The mission to Tripoli was postponed twice due to escalating tensions, until the security situation briefly improved and the FCI team was finally allowed to travel to Tripoli. A week-long stay enabled meetings with a diverse group of stakeholders, including the Central Bank of Tripoli (CBL), Libya Credit Information Center, Insurance Supervision Authority, deposit insurance fund, and select banks, leasing and insurance companies. The team later held consultations with the CBL in Tunis and Rome to discuss the report and its recommendations and was able to finalize the study in the summer of 2020.

The report finds that the financial sector in Libya is characterized by several unique features.

First, there are two central banks operating in the country. The CBL (Tripoli) is under the control of the UN-supported GNA government in Tripoli. The rival central bank in Bayda, Eastern Libya, is under the control of the Eastern government. The split in the central banks has stymied control over monetary and fiscal policy and performance of full bank supervision, because both central banks print money and issue currency without coordinating and in the absence of overarching fiscal policy controls. Libyan dinar has dramatically declined in value, which has led to unequal foreign exchange accessibility.

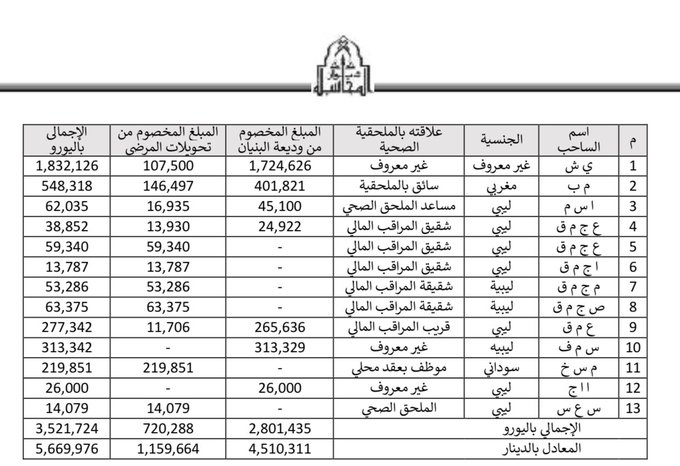

Second, the Central Bank remains the majority shareholder of public banks, which holds 90% of deposits and loans in the system, while being the regulatory agency of the banking sector. This prompts conflicts of interest, including potential forbearance to the benefit of state-owned banks, as well as granting credit to well-connected beneficiaries. While the authorities were considering some reforms in this area, all attempts have been temporarily put on hold in the light of the current crisis.

Third, banks have neither sufficient information nor capacity to make informed credit decisions. The banking sector itself is undercapitalized, and the state-owned banks have particularly questionable asset value.

Finally, initiatives and progress in the financial sector beyond banking have all but frozen. The stock exchange has essentially been on hold with very little public trading. Other forms of finance, such as leasing and insurance, remain embryonic. Given the underdeveloped state of the financial sector, small businesses, individuals, as well as refugees and migrants tend to be underserved.